2024 ATHLETICS BOND PROPOSAL

- Please Vote may 7

Better Together

For generations, North Muskegon Public Schools and the City of North Muskegon have maintained a unique partnership that allows the district to use the city’s parks and recreational facilities for athletic programming. This May, our community will consider a tax rate increase of 1.00 mills to make important improvements to extend the life of these facilities. A homeowner of a $200,000 house would pay approximately $100 more per year.

FAQs

When will the vote be held?

-

The election is scheduled for May 7th. However, absentee ballots will start arriving on March 28th, allowing for early voting.

What makes this athletic bond unique?

-

This bond represents a unique partnership between the school district and the city, utilizing braided funding sources that include the district, the city, and state and federal grants. This collaborative approach maximizes the impact of taxpayer contributions to enhance our athletic facilities.

How much will the homeowner pay if this millage is approved?

-

The proposal includes a tax increase of 1.00 mill. For a homeowner with a property valued at $200,000, this would result in an additional $100 per year in taxes.

How much funding will the bond provide for athletic facilities?

-

If approved, the millage will provide $5.6 million to invest in upgrading athletic facilities, significantly enhancing the quality and accessibility of our sports programs.

What improvements can we expect with the passage of the bond?

-

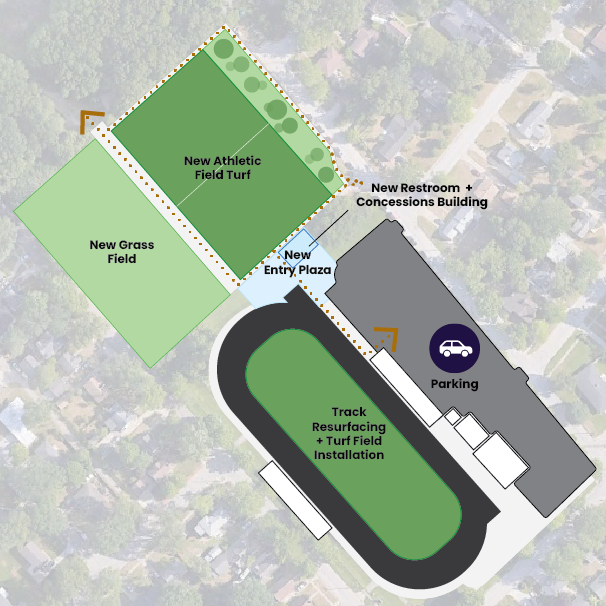

The passage of the bond will allow North Muskegon to upgrade the main stadium with an actual stadium entrance, a new concession stand and restroom building, and enhanced fan and visitor experiences. The introduction of synthetic turf will allow for the stadium's use in heavy rain and quickly after heavy snow, and the track will be resurfaced.

Why is synthetic turf being considered over natural grass?

-

Synthetic turf offers significantly higher durability and usability compared to natural grass. It can withstand heavy use without rest periods, meaning physical education classes and sports teams can use the field throughout the day, including hosting games like football without issue.

How does this bond benefit the community and the students?

- This bond directly benefits the community and students by providing high-quality athletic facilities that support physical education, sports programs, and community events. Enhanced facilities contribute to a vibrant school spirit, improve student engagement, and encourage community participation in school activities.

Didn’t voters already approve a recreation millage for similar upgrades a few years ago? How is this bond different?

- While it's true that a recreation millage was passed in 2019 by the City, this new athletic bond aims to build upon and complete the work that was started with that initial funding. The previous millage laid the groundwork for improvements, but it alone was not sufficient to fully realize the vision for our athletic facilities. This bond fulfills the original plan from the City and District by collaborating and leveraging funding from both local and federal sources. This partnership approach allows us to accomplish far more than either entity could achieve on its own, representing a significant win for the North Muskegon community by providing comprehensive and lasting upgrades to our athletic facilities.

Why use a multifaceted financing approach and why is it important for this project?

- The multifaceted financing approach refers to the strategic use of multiple funding sources, including district funds, city contributions, and state & federal grants, to finance a project. For this athletic bond, braided funding is crucial because it allows us to pool resources and maximize the impact of each dollar spent. By combining our efforts and funds, we can ensure that the athletic facilities receive the comprehensive upgrades needed, benefiting everyone in the North Muskegon community. This collaborative approach not only enhances our ability to complete the project but also demonstrates a commitment to fiscal responsibility and community partnership.

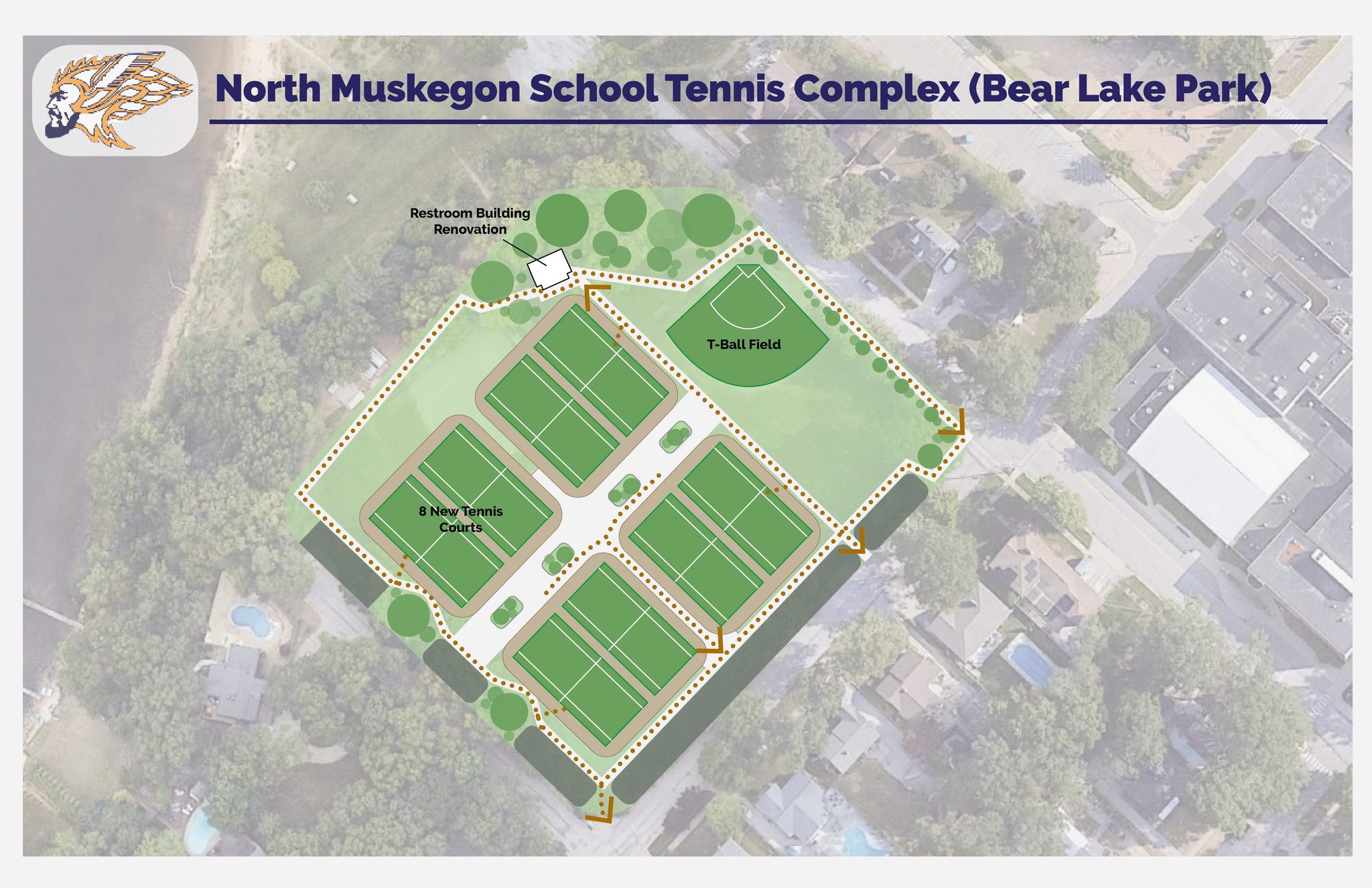

When would construction start, and in what order?

- At this time, the work at Fred Jacks Field would occur in the Spring and Summer of 2025. The bathroom facility at Block 58 is planned to be done in Spring of 2025 or sooner. All other projects partnering with the City would occur on that project's timelines.

Can I vote for pieces of this proposal or is it all voted on as a whole?

- This Bond includes all work listed and is voted on as a whole.